Quickbooks project accounting is your essential guide to mastering project finances. This comprehensive resource delves into how to effectively leverage QuickBooks for detailed project cost tracking, revenue management, and profitability analysis, transforming complex financial data into actionable insights.

We will explore the core functionalities of QuickBooks designed to streamline project management from start to finish. You’ll discover how to meticulously track costs, recognize revenues, and monitor profitability on a per-project basis, giving you unparalleled control over your business’s financial health. The distinct advantages of using dedicated project accounting features over general bookkeeping will be highlighted, showcasing how QuickBooks empowers businesses undertaking multiple or intricate projects.

Furthermore, we’ll walk through the initial setup procedures, including chart of accounts considerations and project creation workflows, ensuring a solid foundation for your project accounting endeavors. Finally, a comparative overview using an HTML table will illustrate the enhanced reporting capabilities for project-specific financial data versus standard QuickBooks financial statements.

Unveiling the Foundational Principles of QuickBooks Project Accounting and Its Fundamental Purpose for Businesses

QuickBooks Project Accounting is a powerful suite of tools designed to provide businesses with granular control and insightful visibility into the financial performance of individual projects. Its fundamental purpose is to move beyond traditional, company-wide bookkeeping to offer a project-centric view of finances, enabling better decision-making, improved profitability, and more accurate forecasting. For businesses that operate on a project basis, whether it’s construction, consulting, event management, or software development, understanding the true cost and revenue of each endeavor is paramount.

QuickBooks Project Accounting addresses this need by integrating project tracking directly into the core accounting functions, ensuring that every dollar spent and earned is accurately allocated and analyzed against its intended project. This focus allows businesses to identify which projects are most profitable, which are underperforming, and where resources might be better allocated, ultimately driving business growth and efficiency.

Core Functionalities for Project Management

QuickBooks Project Accounting is engineered with a suite of core functionalities that specifically cater to the lifecycle of a project, from its initial planning stages through to its final completion and review. At its heart is the ability to meticulously track costs associated with each project. This includes direct costs such as labor, materials, and subcontractor expenses, as well as indirect costs like overhead that can be allocated to specific projects.

For instance, when a consultant bills hours for a particular client engagement, those hours are logged and directly attributed to that client’s project. Similarly, the purchase of specialized materials for a construction job is categorized under that specific build. Revenue tracking is equally robust. QuickBooks allows for the recording of invoices and payments against individual projects, ensuring that all income generated is clearly linked to the work performed.

This is crucial for understanding billing accuracy and payment cycles for each project.The system’s ability to monitor profitability on a per-project basis is a significant differentiator. By consolidating all tracked costs and revenues for a given project, QuickBooks can automatically calculate its profitability. This provides business owners and project managers with real-time insights into the financial health of each undertaking.

For example, a marketing agency can quickly see if a particular campaign project is meeting its expected profit margins, or if unexpected expenses are eroding its profitability. This granular view empowers proactive management; if a project is trending towards unprofitability, managers can investigate the cost drivers or revenue shortfalls and implement corrective actions before significant losses occur. Furthermore, QuickBooks Project Accounting facilitates the management of work-in-progress (WIP), allowing businesses to accurately report the value of ongoing projects and their associated costs and revenues, which is particularly important for businesses that recognize revenue over time.

Distinct Advantages of Dedicated Project Accounting Features

Employing dedicated project accounting features within QuickBooks offers significant advantages over relying solely on general bookkeeping methods, especially for businesses juggling multiple or complex projects. General bookkeeping, while essential for overall financial health, typically provides a high-level view of income and expenses for the entire business. Project accounting, conversely, drills down into the specifics of each project, offering a much deeper level of financial insight.

For instance, a general ledger might show a total expense for “materials,” but project accounting will break down that expense by project, revealing precisely how much of those materials were used for Project A versus Project B. This distinction is critical for accurate cost allocation and for understanding the true cost of delivering a specific product or service.One of the most compelling advantages is enhanced profitability analysis.

With general bookkeeping, determining the profitability of an individual project can be a manual and time-consuming process, often involving complex spreadsheets and estimations. QuickBooks Project Accounting automates this by directly linking all associated costs and revenues to a specific project. This allows businesses to easily identify their most and least profitable projects, enabling strategic decisions about resource allocation, pricing, and future project selection.

Consider a software development firm; project accounting can highlight which types of projects, such as custom enterprise solutions versus off-the-shelf product enhancements, yield higher profit margins, guiding their business development efforts.Furthermore, project accounting in QuickBooks significantly improves budgeting and forecasting. By having historical cost and revenue data for similar past projects, businesses can create more accurate budgets for new projects.

This reduces the likelihood of budget overruns and allows for more reliable revenue projections. When a construction company plans a new building project, past data from similar builds managed through QuickBooks Project Accounting can inform estimates for labor, materials, and timelines, leading to a more realistic and achievable budget. This also aids in cash flow management, as businesses can better anticipate when expenses will be incurred and when revenue is expected, leading to smoother financial operations.

The ability to track change orders and their financial impact on a project is another key benefit, ensuring that scope creep doesn’t go unnoticed and that clients are billed appropriately for any additions.

Initial Setup Procedures for QuickBooks Project Accounting

The initial setup for activating and configuring QuickBooks Project Accounting is a crucial step that lays the groundwork for effective project financial management. It involves a series of deliberate actions to ensure the system is tailored to your business’s specific project workflows and accounting practices. The first fundamental step is to ensure you are using a QuickBooks version that supports project accounting features, such as QuickBooks Desktop Premier Contractor Edition or QuickBooks Online Plus/Advanced.

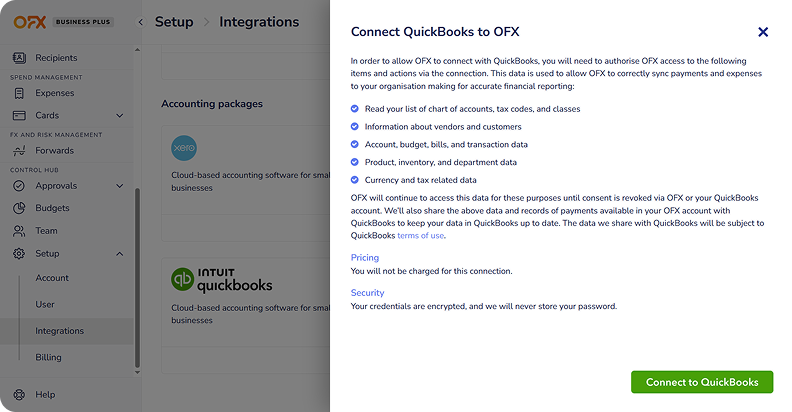

Once confirmed, the process typically begins with setting up your Chart of Accounts with project-specific considerations. While you don’t necessarily need to create entirely new accounts for every project, it’s beneficial to have accounts that can accommodate project-based tracking. For example, you might have standard revenue and expense accounts, but within these, you’ll designate transactions as belonging to a specific project.A key aspect of setup involves enabling the project tracking feature within QuickBooks.

In QuickBooks Desktop, this is often found under the “Company” menu, within “Preferences,” and then under “Jobs & Estimates.” In QuickBooks Online, project tracking is a feature that needs to be activated and may be found under “Account and Settings” or within the “Projects” tab. Once enabled, you can begin creating individual projects. The project creation workflow typically involves entering a project name, which should be descriptive and easily identifiable, and optionally assigning a client to the project if it’s client-facing.

You can also set a project start and end date, and even assign a project manager.Essential chart of accounts considerations include ensuring you have accounts that can capture direct project costs (e.g., Cost of Goods Sold accounts for materials, Payroll Expense accounts for labor) and revenue. For more sophisticated tracking, you might set up sub-accounts to differentiate between different types of project expenses.

For instance, under “Job Expenses,” you could have sub-accounts for “Materials,” “Subcontractors,” and “Travel.” When entering transactions, such as paying a vendor for materials or running payroll, you will then select the relevant project from a dropdown list. This is the core mechanism by which QuickBooks allocates costs to specific projects. It’s also advisable to set up specific “Customer Type” or “Item” lists that are project-related, which can streamline data entry and reporting.

Comparative Overview of Reporting Capabilities

QuickBooks Project Accounting significantly enhances reporting capabilities by offering specialized views for project-specific financial data, which are distinct from the standard financial statements generated for the entire business. Standard financial statements, such as the Profit and Loss (P&L) statement and the Balance Sheet, provide a consolidated overview of the company’s financial performance and position. The P&L shows total revenue, cost of goods sold, and expenses across the entire organization, while the Balance Sheet summarizes assets, liabilities, and equity.

While invaluable for overall financial health assessment, these statements do not offer the granular detail required to evaluate the performance of individual projects.Project-specific reports, on the other hand, are designed to isolate and analyze the financial data of each project. This includes reports like the “Job Profitability Detail” or “Project Income by Job” in QuickBooks Desktop, and similar “Project Reports” in QuickBooks Online.

These reports allow businesses to see, for each project:* Total Revenue: The total amount billed and recognized for the project.

Total Costs

All expenses directly attributed to the project, including labor, materials, subcontractors, and overhead.

Gross Profit

The difference between total revenue and total costs for that specific project.

Profit Percentage

The gross profit expressed as a percentage of total revenue, providing a clear indicator of project efficiency.The following table illustrates the differences in reporting capabilities:

| Report Type | Focus | Granularity | Primary Use Case | Example Data |

|---|---|---|---|---|

| Standard P&L | Overall Company Financial Performance | Consolidated | Assessing total business profitability, tax preparation | Total Revenue: $500,000; Total Expenses: $400,000 |

| Project Profitability Report | Individual Project Financial Performance | Project-Specific | Evaluating the success of each project, identifying profitable ventures, managing project budgets | Project Alpha Revenue: $100,000; Project Alpha Costs: $70,000; Project Alpha Profit: $30,000 (30%) |

| Balance Sheet | Company’s Financial Position at a Point in Time | Consolidated | Understanding assets, liabilities, and equity | Total Assets: $1,000,000; Total Liabilities: $300,000 |

| Project Cost Summary | Detailed Breakdown of Costs for a Single Project | Itemized by Project and Expense Type | Analyzing where project funds are being spent, identifying cost-saving opportunities | Project Beta Materials: $15,000; Project Beta Labor: $25,000; Project Beta Subcontractors: $10,000 |

This detailed comparison highlights how project accounting reports empower businesses to move beyond a general understanding of their finances to a precise, actionable insight into the performance of each individual project, which is essential for informed decision-making and ultimately, improved profitability.

Elaborating on the intricate processes of tracking project expenses and their accurate allocation within QuickBooks.

Effectively managing project finances hinges on the precise tracking and allocation of expenses. QuickBooks Project Accounting provides robust tools to ensure that every dollar spent on a project is accounted for, categorized correctly, and linked directly to its intended job. This meticulous approach is fundamental for understanding project profitability, controlling costs, and making informed business decisions. Without accurate expense tracking, projects can quickly spiral out of budget, leading to financial losses and missed opportunities.The process begins with understanding the different types of costs associated with a project and how to input them into QuickBooks so they are correctly associated with a specific job.

This involves not just direct labor and materials but also the more complex indirect costs and overhead that contribute to the overall project expenditure. By setting up a clear system from the outset, businesses can gain a comprehensive view of their project financials, enabling better forecasting and resource management.

Recording Various Types of Project-Related Expenses in QuickBooks

Accurately capturing all project-related expenses is a cornerstone of effective project accounting. QuickBooks offers flexibility in how you record these costs, ensuring that both direct and indirect expenditures are properly documented and attributed. This detailed recording process is crucial for generating accurate financial reports and understanding the true cost of each project.A step-by-step guide to recording expenses typically involves:

- Direct Costs: These are expenses directly attributable to a specific project. For example, materials purchased solely for Project A, or labor hours logged by an employee working exclusively on Project A. When entering a bill or expense in QuickBooks, you’ll select the relevant vendor or employee, the expense account (e.g., “Materials,” “Subcontractor Labor”), and crucially, assign it to the specific “Customer:Job” field representing the project.

- Indirect Costs: These are costs that benefit multiple projects or the business as a whole but are still project-related. Examples include shared equipment rental, general office supplies used by project teams, or travel expenses for project managers overseeing multiple jobs. When recording these, you might still use a direct expense account, but instead of assigning it to a specific Customer:Job, you might use a “Class” to denote the type of indirect cost or a specific project management department.

Alternatively, for more sophisticated tracking, you might create specific expense accounts for common indirect costs.

- Overhead Allocations: This is often the most complex aspect. Overhead costs, such as rent for office space, utilities, or administrative salaries, are not directly tied to a single project. QuickBooks doesn’t automatically allocate overhead. Businesses typically need to establish a method for allocating a portion of these overhead costs to projects. This can be done by creating specific journal entries periodically (e.g., monthly) to debit project cost accounts and credit overhead expense accounts.

The allocation basis (e.g., based on direct labor hours, direct material costs, or project revenue) needs to be defined and consistently applied. For instance, if a project uses 10% of the company’s total direct labor hours, it might be allocated 10% of the monthly rent.

The key to success lies in consistency and a well-defined chart of accounts. Ensuring that expense accounts are set up logically and that every transaction is linked to the correct project or allocation mechanism is paramount. This detailed input directly impacts the accuracy of project profitability reports.

Methods for Assigning Expenses to Specific Projects

QuickBooks offers several powerful methods for assigning expenses to specific projects, allowing businesses to choose the approach that best suits their operational structure and reporting needs. The accuracy of these assignments directly influences the insights gained into project performance and overall business profitability.Here are the primary methods for assigning expenses:

- Customer:Job Fields: This is the most direct and commonly used method for project-specific expenses. When you create a new project in QuickBooks, you set it up as a “Job” under an existing “Customer.” During data entry for bills, checks, or expenses, you simply select the relevant Customer:Job from the dropdown menu. This ensures that the expense is directly tied to that particular project.

For example, if you purchase lumber specifically for the “Renovation Project” for “Client X,” you would select “Client X:Renovation Project” when recording the expense. This method provides clear visibility into direct project costs.

- Classes: Classes in QuickBooks are a versatile tool for tracking income and expenses across different segments of your business, including projects, departments, or service lines. You can set up classes to represent specific projects, or you can use classes to categorize types of expenses that might be shared across multiple projects (e.g., “Marketing,” “R&D”). When recording an expense, you can assign it to a Customer:Job AND a Class.

This allows for a dual-level of tracking. For instance, a travel expense for a project manager could be assigned to “Client Y:Website Redesign” (Customer:Job) and also to the “Project Management” Class, helping to analyze the cost of management across all projects.

- Custom Project Tracking Features (via Third-Party Apps or Advanced QuickBooks Features): While QuickBooks Desktop Enterprise and QuickBooks Online Advanced offer more sophisticated project management capabilities, many businesses leverage third-party integration apps. These apps often provide enhanced project management features, allowing for more granular tracking of tasks, resources, and costs. They can integrate seamlessly with QuickBooks, pushing categorized project expenses directly into the accounting software. Some advanced features might include custom fields directly on transactions that can be designated for project-specific data points beyond the standard Customer:Job or Class fields, offering a highly tailored approach to expense allocation.

The choice of method often depends on the complexity of the projects, the number of concurrent projects, and the desired level of detail in reporting. Often, a combination of these methods provides the most comprehensive tracking solution.

The Importance of Categorizing Expenses Accurately for Effective Project Cost Control and Profitability Analysis

Accurate expense categorization within QuickBooks is not merely an administrative task; it’s a strategic imperative for effective project cost control and insightful profitability analysis. When expenses are correctly categorized, businesses gain a clear and granular understanding of where their money is going, enabling them to identify cost drivers, detect inefficiencies, and ultimately, improve project margins.Here’s why precise categorization is so critical:

- Precise Project Costing: By assigning expenses to specific project accounts or job fields, you can see the exact cost incurred for each individual project. This allows for accurate billing, better forecasting of future project costs, and a realistic assessment of project profitability. Without this, a project’s true cost remains hidden, leading to underestimation of expenses and potential financial losses.

- Cost Control and Variance Analysis: When expenses are categorized consistently, you can compare actual spending against budgeted amounts for each project. This variance analysis highlights areas where spending is exceeding expectations, prompting investigations into the causes. For example, if the “Subcontractor Labor” category for a specific project is significantly higher than budgeted, management can investigate whether this is due to scope creep, inefficient resource allocation, or unexpected price increases.

- Profitability Analysis: The ultimate goal of most projects is profitability. Accurate expense categorization is the foundation for calculating project profitability. By subtracting the total categorized project costs from the project’s revenue, you arrive at the net profit for that specific endeavor. This enables businesses to identify their most profitable projects, understand what makes them successful, and replicate those successes. Conversely, it helps pinpoint unprofitable projects, allowing for corrective actions or strategic decisions about future project selection.

- Informed Decision-Making: Reliable data derived from accurate expense categorization empowers better business decisions. This includes pricing strategies for future projects, resource allocation, investment in specific services or product lines, and overall business strategy. For instance, if analysis shows that projects involving a particular type of service consistently incur high material costs, the business might explore alternative suppliers or revise its service offerings.

- Auditing and Compliance: For tax purposes and potential audits, having well-categorized expenses is essential. It provides a clear audit trail, demonstrating how funds were spent and supporting financial statements. This reduces the risk of penalties and ensures compliance with financial regulations.

In essence, treating expense categorization as a critical component of project management transforms QuickBooks from a simple bookkeeping tool into a powerful strategic financial management system.

Procedure for Handling Billable Versus Non-Billable Project Expenses

Differentiating between billable and non-billable project expenses is fundamental for accurate invoicing, revenue recognition, and understanding true project profitability. QuickBooks provides mechanisms to easily track and report on these distinctions, ensuring that clients are billed appropriately for services rendered and that internal costs are accounted for without being passed on to clients.Here’s a procedure for effectively handling billable versus non-billable expenses in QuickBooks:

- Establish Clear Policies: Before implementing any system, define what constitutes a billable expense and what is considered non-billable. This policy should be communicated to all team members involved in project work. Generally, direct costs incurred specifically for a client’s project that are contractually agreed upon as billable are considered billable. Indirect costs, internal administrative costs, or expenses incurred due to internal errors are typically non-billable.

- Utilize the “Billable” Checkbox in QuickBooks: When entering a bill, check, or expense transaction in QuickBooks, there is a “Billable” checkbox associated with the line item. This is the primary tool for marking an expense as billable to a specific customer or job.

- For Billable Expenses: When you enter an expense (e.g., a subcontractor’s invoice for work done on Client A’s project), select the appropriate vendor, expense account, and assign it to “Client A: Project Alpha” (Customer:Job).

Crucially, check the “Billable” box on that line item. You can also assign a markup percentage if applicable.

- For Non-Billable Expenses: If an expense is not meant to be passed on to the client (e.g., office supplies used by your internal team, or travel expenses for an internal project review), you would still assign it to a Customer:Job if it’s project-related, but you would leave the “Billable” checkbox unchecked. If the expense is not project-specific at all, you might not assign it to a Customer:Job.

- For Billable Expenses: When you enter an expense (e.g., a subcontractor’s invoice for work done on Client A’s project), select the appropriate vendor, expense account, and assign it to “Client A: Project Alpha” (Customer:Job).

- Create Separate Income Accounts (Optional but Recommended): For enhanced reporting, consider creating separate income accounts for billable expenses and perhaps for reimbursements. This allows for clearer tracking of revenue generated directly from billable expenses.

- Run Reports to Monitor and Invoice: QuickBooks offers several reports that highlight billable versus non-billable expenses:

- “Unbilled Costs by Job” Report: This report is invaluable. It lists all expenses that have been marked as billable but have not yet been invoiced to the customer. This report serves as your primary tool for generating client invoices.

- “Profit and Loss by Job” Report: When used in conjunction with proper expense categorization, this report can show the profitability of each project, taking into account both direct costs and billable expenses.

- “Expenses by Vendor Summary” or “Transaction List by Date” with Filters: These reports can be filtered to show only billable or non-billable transactions, helping in auditing and reconciliation.

- Invoice Generation: When you create an invoice for a customer, QuickBooks will prompt you to add unbilled costs. You can select the specific billable expenses from the “Unbilled Costs by Job” report that you wish to include on the invoice.

- Review and Reconcile: Regularly review your reports to ensure that expenses are being correctly marked as billable or non-billable. Discrepancies can lead to lost revenue or incorrect client billing. Reconciling these reports with your actual invoices and financial statements is a critical step in maintaining financial accuracy.

By consistently applying this procedure, businesses can ensure that their invoicing is accurate, their project costs are properly managed, and their profitability analysis reflects the true financial performance of each project.

Illustrating the methods for managing project revenues and invoicing within QuickBooks.

Effectively managing project revenues and ensuring accurate invoicing are critical for the financial health of any business engaged in project-based work. QuickBooks offers robust tools to streamline these processes, moving beyond simple expense tracking to provide a comprehensive solution for revenue recognition, billing, and payment management. This section delves into how QuickBooks empowers businesses to handle project revenues, from initial setup to final payment, ensuring profitability and client satisfaction.

The core of successful project accounting lies in recognizing revenue when it’s earned and invoicing clients promptly and accurately. QuickBooks facilitates this by allowing businesses to define how revenue is recognized based on project type and contractual agreements. This flexibility ensures that accounting practices align with both business needs and accounting standards, preventing over- or under-reporting of income.

Project-Based Revenue Recognition and Tracking

QuickBooks enables businesses to set up and meticulously track project-based revenue recognition, accommodating various billing models essential for diverse project structures. For businesses operating on a fixed-price basis, where a set amount is agreed upon for the entire project, QuickBooks allows for revenue to be recognized either upon project completion or in stages as milestones are achieved. This can be managed through deferred revenue accounts, where payments received in advance are held until the revenue is earned.

The setup involves creating a project in QuickBooks and then associating the fixed price with it. As work progresses, the business can periodically adjust the earned revenue based on the percentage of completion, which is often a manual estimation process or can be tied to specific deliverables. QuickBooks supports the creation of “Unbilled Revenue” or “Accrued Revenue” accounts to track revenue that has been earned but not yet invoiced.

This is crucial for accurate financial reporting, particularly for interim financial statements. For example, a web design agency might have a $10,000 fixed-price contract. If 50% of the design work is completed and approved, they can recognize $5,000 in revenue, even if the final invoice hasn’t been sent. This recognition is recorded in QuickBooks through journal entries, adjusting the earned revenue and unbilled revenue accounts.

The time and materials billing method is another common scenario where QuickBooks shines. Here, clients are billed for the actual hours worked by staff and the cost of materials used, often with a markup. To track this effectively, each employee’s time must be logged against specific projects, and all material costs must be assigned to those same projects. QuickBooks’ robust time-tracking features allow employees to enter their hours directly into the system, categorizing them by customer, project, and activity.

Similarly, expenses and bills for materials can be tagged to specific projects. Revenue recognition in this model typically occurs as the work is performed and materials are consumed. QuickBooks automatically calculates the billable amount based on pre-set hourly rates and material markups, making revenue recognition and invoicing straightforward. For instance, if a consultant bills $100 per hour and works 20 hours on a project, and materials cost $500 with a 20% markup, the revenue recognized for that period would be (20 hours

– $100/hour) + ($500

– 1.20) = $2,000 + $600 = $2,600.

Discover how enterprise resource planning has transformed methods in this topic.

QuickBooks can be configured to automatically generate these calculations upon time entry and expense posting.

Progress billing, often used for larger construction or development projects, involves invoicing clients at predefined stages or milestones of the project. This method requires careful coordination between project completion and billing cycles. In QuickBooks, this is typically managed by creating invoices that reflect the value of work completed up to a certain point. Setting up progress billing involves defining these milestones within the project file.

As each milestone is met, a specific invoice is generated for the value associated with that stage. For example, a general contractor for a new home build might have milestones for foundation completion, framing, electrical, and plumbing. Each milestone would have an associated invoice amount. QuickBooks allows for these invoices to be created and scheduled, ensuring that the client is billed according to the agreed-upon schedule.

The system can track the total contract value and the cumulative invoiced amount against each milestone, providing a clear overview of the project’s financial progress and the remaining balance to be billed. This method is particularly useful for managing cash flow on long-term projects, ensuring that the business receives payments as work is completed, rather than waiting until the very end.

Generating Accurate and Timely Project Invoices

The process of generating accurate and timely invoices for projects directly from QuickBooks is designed to be seamless and efficient, ensuring that all relevant project costs and agreed-upon markups are meticulously included. Once project expenses and billable time have been diligently tracked and allocated within QuickBooks, the system is primed to create invoices that reflect the true cost and agreed profitability of the project.

The first step involves navigating to the “Customers” or “Sales” menu and selecting “Create Invoices.” QuickBooks prompts the user to select the relevant customer and then allows for the selection of specific projects associated with that customer. This is where the magic happens: QuickBooks can automatically pull in all the unbilled time entries and unbilled expenses that have been tagged to that particular project.

For time and materials projects, the system will apply the predefined billable hourly rates for labor and the agreed-upon markups for materials. For fixed-price projects, the invoice can be generated for a specific milestone amount or a pre-determined installment. The system provides a preview of the invoice, allowing for a final review to ensure all details are correct, including quantities, rates, and any applicable taxes or discounts.

This preview is crucial for catching any discrepancies before the invoice is sent to the client. For instance, if a project involved 40 hours of consulting at $150/hour and $1,000 worth of software licenses with a 15% markup, QuickBooks would automatically calculate the total billable amount. The invoice would clearly itemize the labor hours and their cost, as well as the software licenses and their marked-up price, totaling the exact amount due.

This level of detail not only ensures accuracy but also enhances transparency with the client, fostering trust and reducing potential billing disputes. Furthermore, QuickBooks allows for customization of invoice templates, enabling businesses to include their logo, company information, and specific payment terms, projecting a professional image. The ability to generate these invoices directly from the project data eliminates manual data entry, significantly reducing the risk of errors and saving valuable time for the accounting team.

The accuracy of these invoices is paramount. QuickBooks ensures this by directly linking invoice generation to the recorded project activities. If an expense was recorded and assigned to a project, and it’s billable, it will appear as an option to include on the invoice. Similarly, if an employee logged time against a project with a billable rate, that time will be available to be added.

This integration means that the invoice is a direct reflection of the work performed and costs incurred, as captured within the system. For example, a marketing agency working on a campaign might have tracked hours for graphic design, content writing, and social media management, along with expenses for stock photos and advertising placements. When creating the invoice for the client, QuickBooks will present all these billable items.

For descriptions on additional topics like best accounting software for inventory, please visit the available best accounting software for inventory.

The agency can then select which items to include on the current invoice, perhaps based on a progress billing schedule or a full billing cycle. The system automatically calculates the total, including any applicable sales tax, based on the client’s location and your company’s tax settings. This automation is a significant advantage over manual invoicing, where data might be copied from spreadsheets or other systems, increasing the likelihood of typos or missed entries.

The timeliness of invoicing is equally important for cash flow. QuickBooks allows users to schedule invoices to be sent on specific dates, or to quickly generate and send them as soon as project milestones are met or billing periods close. This proactive approach to invoicing helps to shorten the payment cycle and improve the company’s financial liquidity.

Tracking Customer Payments and Outstanding Balances, Quickbooks project accounting

QuickBooks provides sophisticated functionality for tracking customer payments against specific project invoices, offering a clear view of outstanding balances and a comprehensive payment history. When a customer makes a payment, the process of recording it in QuickBooks is straightforward and directly linked to the original invoice. By navigating to the “Customers” menu and selecting “Receive Payments,” users can choose the specific customer and then select the invoice(s) they are paying.

QuickBooks will display the outstanding balance for each invoice, allowing the user to enter the amount received. This payment is then applied directly to the corresponding invoice, reducing its outstanding balance to zero if paid in full, or partially if it’s an installment payment. This direct application is crucial for accurate accounts receivable management. For instance, if a client pays $5,000 towards a $7,500 invoice, QuickBooks records the $5,000 payment and updates the invoice’s status to “Partially Paid” with an outstanding balance of $2,500.

This ensures that the remaining balance is clearly visible and can be followed up on.

The system’s ability to manage outstanding balances is a cornerstone of effective credit control. QuickBooks maintains a real-time ledger of all open invoices and their respective due dates. This allows businesses to easily identify which invoices are past due, by how many days, and which customers have outstanding balances. Reports such as the “A/R Aging Summary” provide a detailed breakdown of receivables, categorized by aging periods (e.g., 0-30 days, 31-60 days, 61-90 days, 90+ days).

This report is invaluable for proactive collection efforts, enabling businesses to prioritize follow-up actions on the oldest outstanding amounts. Furthermore, QuickBooks can be configured to send automated payment reminders to customers for upcoming or overdue invoices, reducing the administrative burden of manual follow-ups. The payment history for each customer is also meticulously recorded. Every payment received, its date, the invoice it was applied to, and the method of payment (e.g., check, credit card, bank transfer) are stored within the customer’s profile.

This historical data is vital for analyzing customer payment behavior, identifying trends, and making informed decisions regarding credit terms for new or existing clients. For example, a business might notice that a particular client consistently pays late or disputes certain charges. This payment history can inform future interactions, such as requiring a larger deposit or adjusting credit limits. The comprehensive nature of this tracking means that at any point, a business can pull up a customer’s record and see exactly what they owe, what they have paid, and when they paid it, providing complete financial transparency and control over project receivables.

QuickBooks Integrated Invoicing vs. Standalone Software

When it comes to managing project invoicing, the choice between using QuickBooks’ integrated system and opting for standalone invoicing software presents distinct advantages and disadvantages. QuickBooks’ integrated approach offers a cohesive financial management ecosystem, while standalone solutions might provide specialized features but require more manual integration. Understanding these differences is key to optimizing business operations.

- Seamless Integration with Project Data: QuickBooks automatically pulls billable time and expenses directly from project tracking modules into invoices. This eliminates manual data entry, significantly reducing the risk of errors and saving time. Standalone software typically requires manual export/import of data or relies on less robust integrations, which can be prone to discrepancies.

- Holistic Financial View: Invoices generated in QuickBooks are immediately reflected in accounts receivable, cash flow forecasts, and profit and loss statements. This provides a real-time, unified view of the business’s financial health. Standalone invoicing software often requires reconciliation with the main accounting system, which can lead to delays and potential inaccuracies.

- Reduced Data Duplication: By having project costs, time tracking, and invoicing within a single platform, businesses avoid entering the same information multiple times. This not only saves time but also ensures data consistency across all financial records.

- Simplified Workflow: The entire process from tracking project expenses to generating invoices and receiving payments can be managed within QuickBooks, creating a streamlined and efficient workflow. This reduces the learning curve and the need for employees to navigate multiple software applications.

- Cost-Effectiveness for Many Businesses: For businesses already using QuickBooks for accounting, the integrated invoicing features are often included in their subscription or are available at a relatively low additional cost. Standalone invoicing software, especially feature-rich ones, can incur separate subscription fees, increasing overall software expenditure.

- Potential for Less Advanced Specialized Features: While QuickBooks’ invoicing is robust, some standalone invoicing software might offer highly specialized features, such as advanced recurring billing options, complex tiered pricing structures, or unique client portal functionalities that might not be present or as developed in QuickBooks.

- Scalability Concerns for Niche Requirements: For businesses with extremely complex or highly specialized invoicing needs that go far beyond typical project billing, a dedicated standalone solution might offer the depth of functionality required. However, for the vast majority of project-based businesses, QuickBooks’ capabilities are more than sufficient.

- Client Communication and Portal: While QuickBooks offers basic email invoicing, some standalone solutions may provide more sophisticated client portals for invoice viewing, payment processing, and communication, which can enhance the client experience.

Exploring the Reporting and Analytical Tools QuickBooks Offers for Project Financial Oversight

QuickBooks Project Accounting is not just about tracking; it’s about understanding. The real power lies in its robust reporting and analytical tools, which transform raw data into actionable insights. These features are crucial for any business managing multiple projects, providing a clear window into profitability, resource allocation, and overall project health. Without these tools, businesses would be flying blind, making decisions based on gut feeling rather than concrete financial evidence.The suite of reports available in QuickBooks is designed to cater to the specific needs of project-based businesses.

They offer a granular view of financial performance, allowing project managers and business owners to pinpoint successes and identify areas requiring immediate attention. From high-level overviews to detailed breakdowns, these reports empower users to maintain control over project finances and make informed strategic decisions.

Key Project Accounting Reports in QuickBooks

QuickBooks offers a variety of pre-built reports tailored for project accounting, each providing a unique perspective on financial performance. Understanding these reports is the first step toward effective project financial management.The Job Profit and Loss report is arguably one of the most critical. It presents a clear picture of the profitability of individual projects (often referred to as “Jobs” in QuickBooks). This report details all revenues earned and all expenses incurred for a specific project within a defined period.

By comparing the total income against total costs, businesses can immediately ascertain whether a project is in the black or red. It breaks down costs by category, such as labor, materials, subcontractors, and overhead, allowing for detailed analysis of where project funds are being spent.Another valuable report is Project Income by Class. While “Class” can be used flexibly, in a project accounting context, it’s often used to categorize projects by type, client, or even by phase.

This report helps in understanding revenue streams across different project categories. For instance, a construction company might use classes to differentiate between residential, commercial, and renovation projects, thereby analyzing which types of projects are generating the most revenue.The Budget vs. Actual report is indispensable for financial control. It compares the budgeted amounts for various project line items against the actual amounts spent or earned.

This comparison highlights variances, showing where projects are over budget or under budget. Proactive management of these variances is key to preventing cost overruns and ensuring profitability.Other useful reports include the Cost Estimates by Job report, which compares the original cost estimate against actual costs, and the Unbilled Revenue report, which identifies projects that have incurred costs but have not yet been invoiced, ensuring that all work performed is captured for billing.

Customizing Reports for Deeper Insights

While QuickBooks provides excellent out-of-the-box reports, their true power is unlocked through customization. Tailoring these reports allows businesses to drill down into specific data points, uncover hidden trends, and gain a more nuanced understanding of project performance.To customize a report, users typically navigate to the report center and select the desired report. From there, a “Customize Report” button or similar option is available.

This opens a dialog box with numerous options.One common customization is filtering. For example, in the Job Profit and Loss report, a user might want to see the performance of only active projects, or projects completed within the last fiscal year. Filters can be applied to dates, customer lists, project names, or even custom fields that have been set up.Another powerful customization is modifying the columns displayed.

The standard Job Profit and Loss report might show broad expense categories. However, a user might want to see a breakdown of labor costs by employee or by labor type. This can often be achieved by adding columns for specific sub-accounts or by using the “Class” or “Customer:Job” breakdown within expense accounts.For the Budget vs. Actual report, customization can involve adding more detailed budget lines or comparing actuals against different budget versions if multiple budgets have been created for a project.

Users can also adjust how variances are displayed, choosing to show them as a dollar amount, a percentage, or both.Adding summary information is also a key customization. For instance, on a report showing expenses by vendor for a project, a user might add a total row to quickly see the overall spend with each vendor. Similarly, for revenue reports, adding subtotals by service item can provide clarity on which services are contributing most to project income.The ability to save customized reports is also invaluable.

Do not overlook the opportunity to discover more about the subject of accounting and business management software.

Once a report is tailored to provide the specific insights needed, it can be saved with a descriptive name, making it easily accessible for future reviews without having to reconfigure it each time. This streamlines the reporting process and ensures consistency in financial analysis.

Strategic Value of Regularly Reviewing Project Financial Reports

The strategic value of consistently reviewing project financial reports cannot be overstated. These reports are not just historical records; they are forward-looking tools that guide decision-making and enable proactive problem-solving. Regular review fosters a culture of financial accountability and allows businesses to adapt quickly to changing project conditions.When project financial reports are reviewed regularly, typically on a weekly or bi-weekly basis, project managers and stakeholders gain early warnings of potential issues.

For instance, a budget vs. actual report might reveal that a specific material cost is significantly exceeding its budgeted amount. This early detection allows the project manager to investigate the cause – perhaps a supplier price increase, inefficient material usage, or an error in initial estimation. Without this regular review, such overages might go unnoticed until much later, when they have a substantial impact on overall project profitability.Furthermore, these reports are crucial for informed decision-making regarding project scope, resource allocation, and pricing for future projects.

If a particular type of project consistently underperforms in terms of profitability, as indicated by the Job Profit and Loss report, the business can make strategic decisions. This might involve re-evaluating the pricing structure for similar projects, improving estimation processes, or even deciding to focus on more profitable project types.Proactive problem-solving is a direct benefit of regular report review. Identifying cost variances allows for corrective actions.

For example, if labor costs are trending higher than expected, the business can investigate the reasons. This could lead to implementing better time-tracking mechanisms, optimizing team assignments, or providing additional training to improve efficiency. Similarly, if revenue is lagging, the sales or project management team can proactively address client communications or explore opportunities for upselling additional services.Ultimately, the consistent use of QuickBooks project reports fosters a more agile and resilient business.

It shifts the focus from reactive firefighting to proactive management, ensuring that projects remain on track financially and contribute positively to the company’s bottom line. This disciplined approach to financial oversight is a cornerstone of sustainable business growth in project-driven industries.

Interpreting Project Profitability Metrics

Understanding how to interpret the metrics within QuickBooks project reports is key to discerning the financial health of your projects. These metrics provide a quantitative basis for evaluating success and identifying areas of concern.The Net Operating Income on the Job Profit and Loss report is a primary indicator of project profitability. A positive Net Operating Income signifies that the project is generating more revenue than it is costing to complete.

For example, if a project generates $100,000 in revenue and incurs $80,000 in expenses, the Net Operating Income is $20,000, indicating a successful project from a profitability standpoint. Conversely, a negative Net Operating Income means the project is losing money.The Gross Profit Margin is another crucial metric, often calculated as (Revenue – Cost of Goods Sold) / Revenue. While QuickBooks may not always present this as a direct percentage on every report, the underlying data is there.

A healthy Gross Profit Margin suggests that the direct costs of delivering the project are well-managed relative to the revenue generated. For instance, a 30% Gross Profit Margin means that for every dollar of revenue, $0.30 is left after covering the direct costs of that revenue. This margin needs to be sufficient to cover overhead and still leave a net profit.When reviewing the Budget vs. Actual report, the Variance column is paramount.

A positive variance in an expense category (e.g., Materials) indicates that the project has spent more than budgeted. If the budget for materials was $5,000 and the actual spend is $6,500, the positive variance of $1,500 signals a potential problem. Conversely, a negative variance in revenue suggests that the project is earning less than anticipated. For instance, if the budgeted revenue was $50,000 and the actual revenue is $45,000, the negative variance of $5,000 indicates a revenue shortfall.Interpreting these variances requires context.

A small variance might be acceptable, but significant or consistent variances warrant immediate investigation. For example, consistently higher labor costs across multiple projects could point to an issue with time tracking, employee efficiency, or an underestimation of the labor required for certain tasks.The Cost of Services or Cost of Sales line items on project reports represent the direct costs associated with delivering the project’s services or products.

If these costs are disproportionately high compared to revenue, it’s a clear sign of struggling profitability. For example, a project with $50,000 in revenue and $45,000 in Cost of Services leaves only $5,000 for overhead and profit. This is a very tight margin, indicating a struggling project that may not be able to absorb any unexpected costs.Analyzing the trends over time is also vital.

A project that starts with positive profitability and then sees its margins erode may be facing unforeseen challenges. Conversely, a project that begins with a slight loss but shows improving profitability as it progresses might be on a recovery path. By consistently monitoring these metrics and understanding what they signify, businesses can make informed decisions to steer projects toward success or to identify and address issues before they become critical.

Examining advanced project accounting features and best practices for optimizing QuickBooks utilization.

Beyond the core functionalities, QuickBooks offers robust advanced features and established best practices that can significantly elevate your project accounting management. By delving deeper into these aspects, businesses can move from simply tracking projects to strategically optimizing their financial performance and ensuring long-term success. This section explores how to leverage QuickBooks for sophisticated budget management, effective change order handling, streamlined project closeout, and seamless integration with other vital business systems.

Effective Utilization of QuickBooks for Managing Project Budgets

Mastering project budget management within QuickBooks is paramount for controlling costs and ensuring profitability. This involves a proactive approach to setting realistic financial parameters, diligently monitoring expenditures against these benchmarks, and employing forecasting techniques to anticipate future financial needs. QuickBooks provides the tools to establish comprehensive budgets, allowing for detailed breakdowns by task, phase, or cost category. This granular approach enables project managers to pinpoint areas of potential overspending early on.

The system’s ability to track actual spending in real-time against these budgeted amounts offers immediate visibility into variances. This constant comparison is crucial for making timely adjustments and preventing budget blowouts. Furthermore, QuickBooks facilitates the forecasting of future project costs by analyzing historical data, current spending trends, and anticipated future expenses. This forward-looking perspective is invaluable for resource allocation, client communication, and strategic decision-making.To effectively utilize QuickBooks for managing project budgets, consider the following:

- Setting Budget Limits: Begin by creating detailed budgets within QuickBooks for each project. This can be done by accessing the “Projects” or “Jobs” section, then selecting “Set Up Budget” or a similar option. Budgets can be established on a total project basis or broken down by specific cost codes, phases, or even individual tasks. For instance, a construction project might have budgets allocated for labor, materials, permits, subcontractors, and overhead, with specific dollar amounts assigned to each.

This level of detail ensures that every anticipated expense is accounted for.

- Tracking Actual Spending Against Budgets: Regularly input all project-related expenses into QuickBooks. This includes vendor bills, payroll expenses, and any direct project costs. QuickBooks automatically compares these actual expenditures to the established budget. You can generate budget vs. actual reports (e.g., “Project Profitability Summary” or “Budget vs.

Actual by Job”) to visualize variances. For example, if the budget for “Electrical Materials” was $5,000 and actual spending has reached $6,500, the report will clearly highlight this $1,500 overage, prompting an investigation into the cause.

- Forecasting Future Project Costs: Leverage QuickBooks’ reporting capabilities and historical data to forecast future costs. While QuickBooks doesn’t have a dedicated forecasting module in its core project accounting, you can achieve this by analyzing trends from “Project Profitability” reports and “Job Cost Summary” reports. If a project is consistently running over budget in a particular area, project managers can use this data to estimate the potential impact on the remaining project duration.

For instance, if the trend of overspending on subcontractors continues at the current rate, you can project the final cost of that category and its effect on the overall project profitability. This proactive estimation allows for adjustments in other areas or for early discussions with stakeholders about potential budget revisions.

Best Practices for Managing Project Change Orders within QuickBooks

Project change orders are an inevitable part of many projects, representing adjustments to the original scope of work. Effectively managing these changes within QuickBooks is critical to maintaining financial accuracy, ensuring clear communication with clients, and preventing disputes. The process involves meticulous documentation of each change, a thorough assessment of its financial implications, and the accurate reflection of these impacts within the QuickBooks accounting system.

This ensures that all costs and revenues associated with approved changes are properly captured and attributed to the correct project.To implement best practices for managing project change orders within QuickBooks, consider the following:

- Formal Documentation of Change Orders: Every change order should originate from a written request, clearly outlining the proposed modification to the project scope. This document should be signed by both the client and the project manager before any work commences or expenses are incurred. Within QuickBooks, you can utilize custom templates for “Change Order Forms” that mirror your standard documentation. Alternatively, you can create specific “Items” or “Service” entries within your Chart of Accounts that are designated for change order work.

This ensures that all costs and revenues related to these changes are segregated and easily identifiable. For example, a change order might add a new room to a house construction project. The change order document would detail the additional square footage, materials, and labor required, and be signed by the homeowner and the contractor.

- Financial Impact Assessment: Before approving a change order, conduct a thorough assessment of its financial impact. This includes estimating the additional labor, materials, subcontractor costs, and any other direct expenses. Also, determine any potential impact on project timelines and overhead. QuickBooks can assist in this by allowing you to create a preliminary “Estimate” or “Sales Order” for the change order, reflecting these anticipated costs and the proposed increase in the project’s revenue.

This step is crucial for providing the client with an accurate quote for the additional work and for internal budgeting. For instance, if a client requests a custom-built cabinet that wasn’t in the original design, you would estimate the cost of the wood, hardware, labor hours, and then add a profit margin to determine the billable amount.

- Accurate Reflection in QuickBooks: Once a change order is approved, it must be accurately reflected in QuickBooks. This typically involves creating a new invoice that incorporates the approved change order amount, or if the original contract was an estimate, updating the estimate to include the change order. If you are using specific “Items” for change orders, you would create a bill or journal entry to record the associated expenses and then an invoice to bill the client for the approved revenue.

For example, if the change order for the custom cabinet was approved at $1,500, you would either add this amount to the existing project invoice or create a separate invoice specifically for the change order work. If you are tracking change order expenses directly, you would enter the bills for materials and labor related to the cabinet under a designated change order cost code within the project.

The Role of QuickBooks in Streamlining Project Closeout Procedures

The successful completion of a project hinges on a well-executed closeout process, and QuickBooks plays a pivotal role in ensuring this transition is smooth, accurate, and compliant. This involves meticulously finalizing all financial aspects, from reconciling outstanding expenses and issuing final invoices to archiving crucial historical data for future reference and analysis. A robust closeout procedure within QuickBooks not only brings closure to the current project but also provides valuable insights that can inform future project planning and execution.QuickBooks facilitates streamlined project closeout procedures through several key functions:

- Final Invoicing: Once all project work is completed and approved, QuickBooks allows for the generation of final invoices. This ensures that the client is billed for the total amount due, including any approved change orders. You can access project-specific invoices and select the option to generate a final billing. If there are outstanding balances, QuickBooks will clearly display them. For instance, a consulting project nearing completion would have its final invoice generated in QuickBooks, encompassing all billable hours, expenses, and any agreed-upon retainers or bonuses.

- Expense Reconciliation: A critical step in project closeout is reconciling all project-related expenses. This involves ensuring that all vendor bills have been entered, all payments have been recorded, and that there are no outstanding or unallocated expenses. QuickBooks’ “Accounts Payable” and “Bank Reconciliation” features are instrumental here. You can run reports like “Unpaid Bills by Job” to identify any lingering obligations.

For example, in a software development project, you would review all invoices from freelance developers, software licenses, and hosting services to ensure they are all accounted for and paid before closing the project.

- Historical Data Archiving: QuickBooks allows for the archiving of completed project data, which is essential for historical record-keeping, tax purposes, and future performance analysis. While QuickBooks doesn’t have a specific “archive” button for individual projects, you can manage this by marking projects as “Inactive” or by creating a company file backup specifically for completed projects. This ensures that the active company file remains uncluttered while preserving all the financial details of past endeavors.

For example, after a marketing campaign project concludes, its financial data—including all campaign expenses, revenue generated, and performance metrics—can be archived for future reference when planning similar campaigns. This allows for the analysis of what worked well and what could be improved in the future.

Framework for Integrating QuickBooks Project Accounting with Other Business Management Tools

To maximize operational efficiency and gain a holistic view of business performance, integrating QuickBooks project accounting with other business management tools is a strategic imperative. This integration creates a seamless flow of data, eliminates manual data entry, reduces errors, and provides a more comprehensive picture of project financials in relation to overall business operations. The framework for such integration typically involves leveraging QuickBooks’ robust API capabilities, utilizing third-party integration partners, or establishing well-defined manual data transfer protocols.A framework for integrating QuickBooks project accounting with other business management tools can be structured as follows:

- Customer Relationship Management (CRM) Systems: Integrating QuickBooks with CRM systems (e.g., Salesforce, HubSpot) allows for a unified view of client interactions and project financial data. When a project is initiated in the CRM, key client details and project scope can be automatically transferred to QuickBooks to set up the new project. Conversely, project status updates or invoice payment information from QuickBooks can be fed back into the CRM to provide sales and account management teams with real-time insights.

For example, a sales team can see if a client has outstanding invoices directly within their CRM, informing their client engagement strategy.

- Time Tracking and Payroll Software: For service-based businesses, integrating time tracking software (e.g., TSheets, Clockify) with QuickBooks is crucial. Employees’ tracked hours can be automatically imported into QuickBooks for payroll processing and direct allocation to specific project tasks. This eliminates manual timesheet entry and ensures accurate labor cost tracking for each project. Similarly, payroll software can be integrated to ensure that all payroll expenses, including taxes and benefits, are correctly assigned to projects.

A law firm, for instance, would use integrated time tracking to bill clients accurately and to understand which cases are most profitable based on labor costs.

- Inventory Management Systems: Businesses that deal with physical goods and project-based inventory needs can benefit from integrating their inventory management systems with QuickBooks. When materials are allocated to a project, the inventory system can automatically update QuickBooks with the cost of goods sold and adjust inventory levels. This ensures that inventory valuations are accurate and that project material costs are captured correctly.

A construction company, for example, would see its inventory of lumber decrease as it’s used on a specific project, with the cost automatically debited to that project’s job cost in QuickBooks.

- Enterprise Resource Planning (ERP) Systems: For larger organizations, integrating QuickBooks with an ERP system can provide a comprehensive business management solution. This integration can encompass finance, human resources, supply chain, and project management. Data flows bidirectionally, ensuring that project financials in QuickBooks are aligned with the broader financial and operational data within the ERP. For example, an ERP system might manage procurement and production planning, with project-specific cost data flowing into QuickBooks for financial reporting and invoicing.

This creates a single source of truth for all business operations.

The strategic integration of QuickBooks project accounting with other business systems transforms it from a standalone accounting tool into a central hub for project financial intelligence, driving efficiency and informed decision-making across the organization.

Last Recap: Quickbooks Project Accounting

In essence, QuickBooks project accounting offers a robust framework for businesses to gain clarity and control over their project finances. By understanding and implementing its core features, from detailed expense tracking and accurate revenue recognition to sophisticated reporting and budget management, you can significantly enhance project profitability and overall business efficiency. Embrace these tools and practices to navigate your projects with confidence and drive sustainable financial success.

Question Bank

What versions of QuickBooks offer project accounting features?

Project accounting features are primarily available in QuickBooks Premier, QuickBooks Enterprise, and QuickBooks Online Advanced. Basic versions may have limited project tracking capabilities.

Can I track multiple projects simultaneously in QuickBooks?

Yes, QuickBooks is designed to handle multiple projects, allowing you to assign costs, revenues, and track performance for each one independently.

How does QuickBooks handle unbilled costs at project completion?

QuickBooks allows you to generate a final invoice that includes all remaining unbilled costs and revenue, ensuring accurate project closure and financial reporting.

Is it possible to import existing project data into QuickBooks?

Yes, QuickBooks offers import functionalities for various data types, including customer lists, vendor lists, and sometimes chart of accounts, which can be adapted for project data import, though specific project data import might require careful mapping.